Unlock the Power of Non-Cash Giving

Give more, more wisely

Non-Cash giving

Reduce taxes and give more to charity by giving appreciated assets such as business interests, real estate, and securities.

With non-cash giving at NCF, you can tap into the full power of your resources and give more than you ever dreamed possible.

Less to taxes

You typically receive a tax deduction for the fair-market value of your gift.

More to charity

The capital gains taxes you potentially save from giving directly means more goes to support charities.

Personal savings

Because you receive the full tax deduction, you may see significant savings on your income tax returns.

You probably dream of giving significantly more to the charities you love, but often that seems out of reach. With non-cash giving at NCF, it’s possible. You transfer part or all your asset to NCF before the sale, thereby potentially reducing or eliminating capital gains taxes, and then we liquidate the asset at the right time. The net proceeds go to your Giving Fund, which you can use to go online to send more to the causes you love.

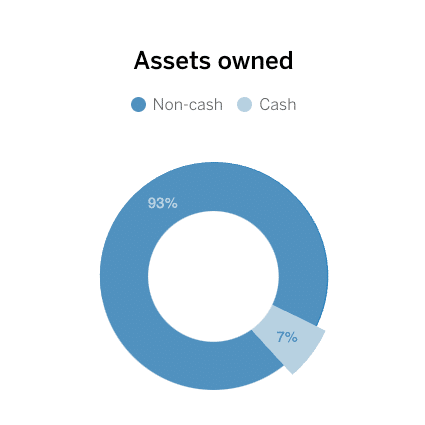

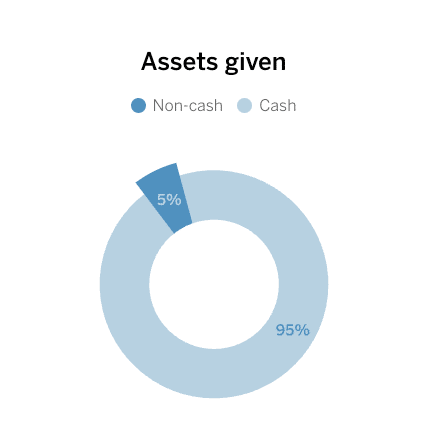

IRS statistics show that most people give from cash, even though their wealth is held in non-cash assets.

Assets we can help you give

Whether you’re passionate about Christian education or ending homelessness, you can do more for the causes you love by giving most any kind of appreciated non-cash asset.

- Appreciated securities

- Real estate

- Business interests

- Personal property

- Restricted securities

- Loan notes

- Estate gifts

- Retirement plans

- Life insurance

Get a Gift Illustration

The tax code encourages us to give assets over cash. Click on one of the gift illustration tools below to see how this could impact your charitable giving. Your NCF Area Director can walk you through the results.